Dollar-Value LIFO Method What is It, Examples, Calculation

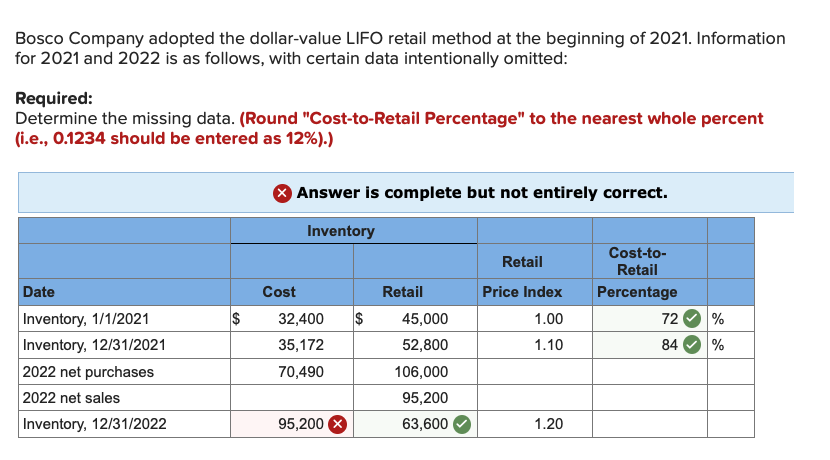

If you choose LIFO, you can further select from one of several submethods, including dollar-value LIFO, or DVL. When the adjusted ending inventory exceeds the beginning inventory, it indicates additional purchases, and a new layer is created for the amount of the increase. Choose a base year for the Dollar Value LIFO method, as it’s the year to which you will compare all subsequent years. You will use the prices in this year as a base to interpret changes in the value of the inventory.

Interpretation of Dollar Value LIFO Formula

Under this method, it is possible to use a single pool but a company can use any number of pools according to its requirement. The unnecessary employment of a large number of dollar-value LIFO pools may, however, increase cost and also reduce the effectiveness of dollar-value LIFO approach. Companies that utilization the dollar-value LIFO method are those that both keep a large number of products, and expect that product mix to change substantially from now on.

- Dollar-value LIFO is an accounting method utilized for inventory that follows the last-in-first-out model.

- This is a crucial consideration for businesses that prioritize cash flow management.

- We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations.

- Companies are now required to provide more detailed information about their inventory valuation methods, including the rationale behind choosing Dollar-Value LIFO and its impact on financial statements.

Related AccountingTools Courses

While learning LIFO and discussing its pros and cons, one issue was of LIFO’s incompatibility if entity is using FIFO for internal reporting purposes. Dollar Value LIFO is a method used in inventory management to evaluate the worth of goods sold and inventory, considering inflation and the changing value of money over time. You could categorise them based on physical similarity, usage, or any other feasible factors. The aim is to form groups comprising items that behave similarly in response to changes in price levels. First, a large number of calculations are required to determine the differences in pricing through the indicated periods. Also, under IRS regulations, a base year cost must be located for each new inventory item added to stock, which can require considerable research.

What is Dollar Value LIFO?

This aids in remarkably simplifying the computations related to the inventory, accounting for the fluctuations in quantities of items in the inventory. Dollar Value LIFO is defined as the method in which the monetary value of the inventory is considered rather than the physical goods when determining the cost of goods sold. This involves grouping similar items together, and then calculating the value of the inventory based on the dollar value rather than the quantity of individual items. In Year 3, there is a decline in the ending inventory unit count, so there is no new layer to calculate.

The how do i find my employers ean method permits companies to try not to compute individual price layers for every thing of inventory. All things considered, they can work out layers for each pool of inventory. In any case, at one point, this is not generally cost-effective, so it’s fundamental to guarantee that pools are not being made superfluously. This decrease in reported profits leads to a reduction in taxable income, thereby potentially optimizing ABC Ltd.’s tax liability under this scenario. The Dollar-Value LIFO method thus helps the company in reflecting the impact of inflation on its financial statements, which is especially beneficial in times of rising costs. The reduction in taxable income and subsequent tax payments can improve operating cash flow.

Dollar-value LIFO method definition

However, this also means higher tax liabilities, as the lower COGS increases taxable income. Dollar-value LIFO uses this approach with all figures in dollar amounts, rather than in inventory units. It provides a different view of the balance sheet than other accounting methods such as first-in-first-out (FIFO).

We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

If you use the year 2020 as a base year, the worth of this layer would be calculated in base-year prices. These inventory pools are a collection of items that are grouped based on their similarities. The controller multiplies this amount by the $15.00 base year cost and again by the 121% current cost index to arrive at a cost for this new inventory layer of $23,595.