Cash Flow Statement: Explanation and Example Bench Accounting

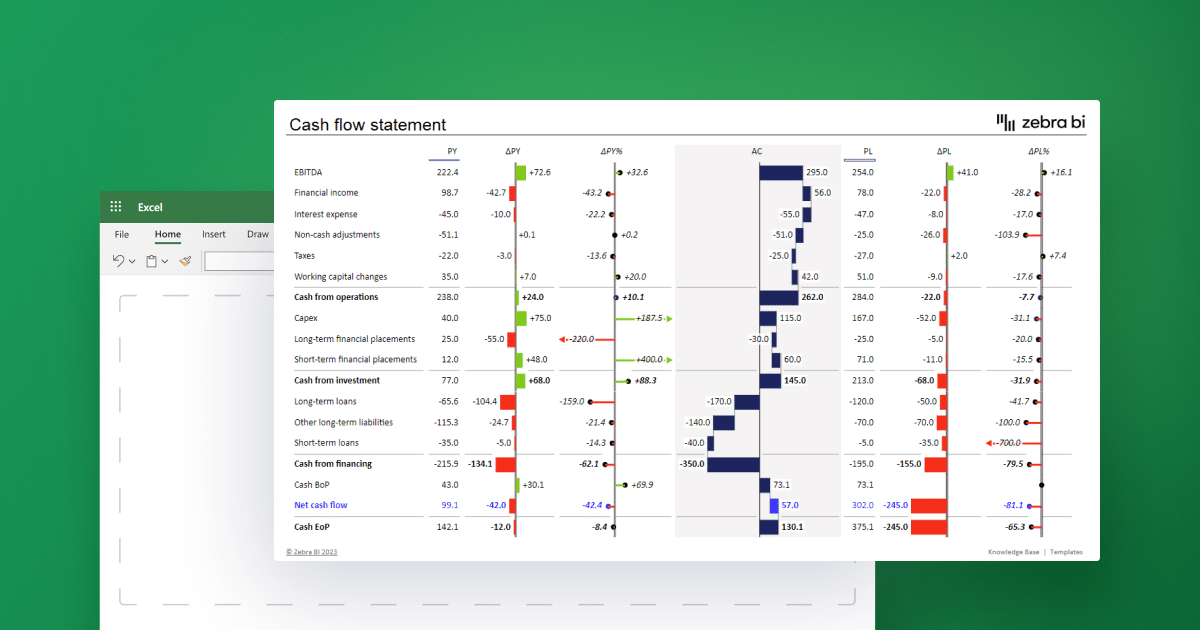

You’ll also notice that the statement of cash flows is broken down into three sections—Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. Let’s look at what each section of the cash flow statement does. Companies can achieve positive cash flow by selling assets or taking on unreasonable financial leverage, even when they’re bleeding cash through their operations.

What is the difference between direct and indirect cash flow statements?

Cash is a company’s most liquid asset; it is the lifeblood of operations. Without adequate cash, and regardless of the long-term assets that may be owned, a business cannot pay employees, creditors, taxes, dividends, or expenses. We begin with reasons why the statement of cash flows (SCF, cash flow statement) is a required financial statement. LO 16.3Analysis of Forest Company’s accountsrevealed the following activity for its Land account, withdescriptions added for clarity of analysis.

How to Prepare a Cash Flow Statement

In contrast, when interest is given to bondholders, the company decreases its cash. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business expense recognition principle and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

- LO 16.4Use the following excerpts from SternCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018.

- No, all of our programs are 100 percent online, and available to participants regardless of their location.

- Learn how to analyze a statement of cash flows in CFI’s Financial Analysis Fundamentals course.

- Long term marketable securities are investments; a long term asset.

Determine the Starting Balance

The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing. Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. This is done in order to come up with an accurate cash inflow or outflow. This section records the cash flow between the company, its shareholders, investors, and creditors. It provides an overview of cash utilized in business financing. Remember the four rules for converting information from an income statement to a cash flow statement?

Prepare a working paper to convert net income from an accrual basis to a cash basis. Then prepare a partial statement of cash flows – direct method, showing only the cash flows from operating activities section. LO 16.4Use the following excerpts from UnigenCompany’s financial information to prepare the operating section ofthe statement of cash flows (indirect method) for the year2018. LO 16.3Use the following excerpts from KayakCompany’s financial information to prepare the operating section ofthe statement of cash flows (indirect method) for the year2018. LO 16.3Use the following information from AcornCompany’s financial statements to determine operating net cashflows (indirect method).

The statement of cash flows adjusts net income to reflect actual cash generated or used, offering a clearer view of liquidity. A company may report high net income but struggle with cash flow issues, signaling potential financial problems. Understanding this relationship helps in assessing the company’s true financial stability and operational efficiency. Under IFRS, there are two allowable ways of presenting interest expense or income in the cash flow statement. Many companies present both the interest received and interest paid as operating cash flows. Others treat interest received as investing cash flow and interest paid as a financing cash flow.

When you have a sale of an asset you must determine the gain or loss and put that in the operating section. Go back to the balance sheet and identify all long-term liability and equity accounts. Cash related to these accounts will be reported in this section. Go back to the balance sheet and identify all long-term asset accounts. Cash related to the changes in these accounts will be reported in this section. Make sure that you use all revenues and expenses that will be paid in cash.

B. The indirect method begins with net income and reconciles net income to cash from operations. Long term marketable securities are investments; a long term asset. Cash related to long term assets is reported in the investing section.

The cash flow statement reflects the actual amount of cash the company receives from its operations. At the bottom of the SCF (and other financial statements) is a reference to inform the readers that the notes to the financial statements should be considered as part of the financial statements. The notes provide additional information such as disclosures of significant exchanges of items that did not involve cash, the amount paid for income taxes, and the amount paid for interest. LO 16.4Use the following excerpts from OpenAirCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from MountainCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018.

It also reconciles beginning and ending cash and cash equivalents account balances. During the reporting period, operating activities generated a total of $53.7 billion. The investing activities section shows that the business used a total of $33.8 billion in transactions related to investments. The financing activities section shows that a total of $16.3 billion was spent on activities related to debt and equity financing. Cash flow analysis is also essential for evaluating the quality of a company’s earnings.

While many companies use net income, others may use operating profit/EBIT or earnings before tax. Learn how to analyze a statement of cash flows in CFI’s Financial Analysis Fundamentals course. The cash flow statement replaced the statement of changes in financial position as the fourth required financial statement. The aim of preparing a cash flow statement is to reconcile the company’s opening cash position with its closing cash position.